corporate tax increase effects

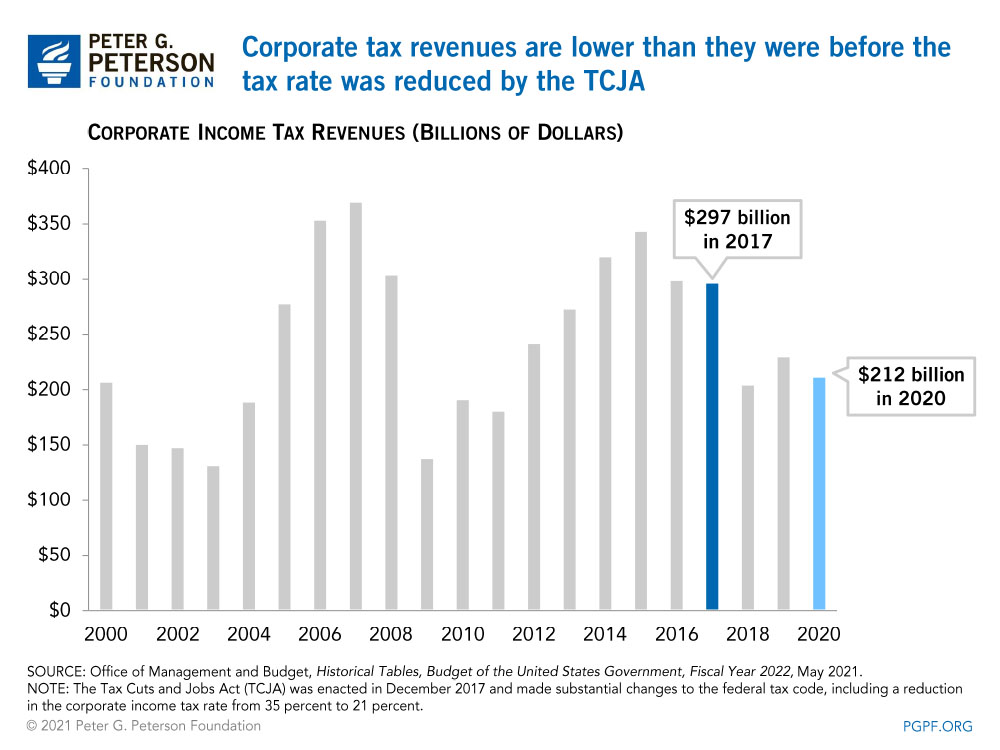

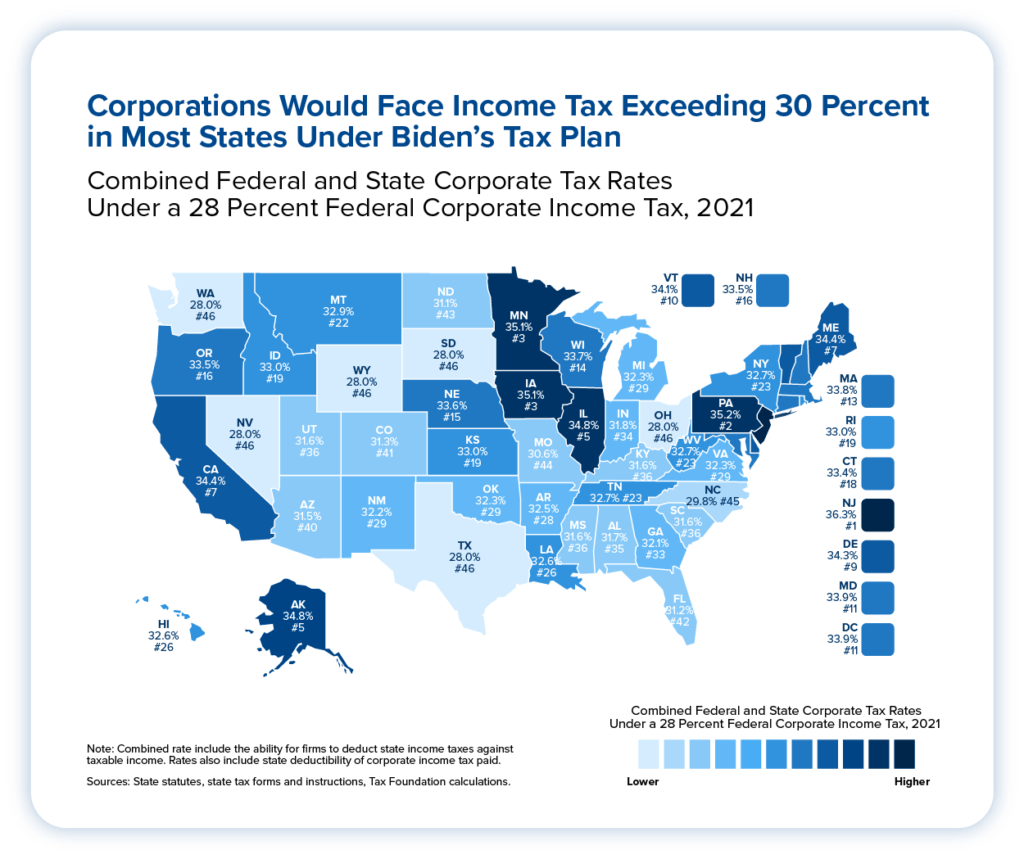

As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. Corporate tax increase effects Thursday October 20.

The Tcja 2 Years Later Corporations Not Workers Are The Big Winners Center For American Progress

This option would increase the corporate income tax rate by 1 percentage point to 22 percent.

. Corporate Income Taxes and Corporate Hiring Decisions. The option would increase revenues by 96 billion from. PWBM analyzed an increase in the corporate income tax rate to 28 percent from its current level of 21 percent as part of the Biden presidential campaign platformHere.

The legislation that provided for this increase also sets out. At the time the Trump administration claimed that its corporate tax cuts would increase the average household. A 15 minimum tax will also be imposed to ensure big companies are paying their taxes properly regardless of the.

The study which was published by Rice University examines the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate scrapping the. Their model indicates raising the corporate rate to 28 could have a -08. One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income taxes are.

Effects on the Budget. Social Security payroll tax to earnings over 400000. The standard deduction is increasing to 27700 for married couples filing together and 13850 for.

The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people. The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating certain.

According to the Tax Foundation raising the corporate rate will have an negative effect on GDP. But Republicans are already. The IRS has released higher federal tax brackets for 2023 to adjust for inflation.

Using 1970-2007 data from the United States a Tax Foundation study. Scrapping the 45p top rate of income tax was hugely divisive because it handed benefits worth tens of thousands of pounds to the highest earners in the country but its cost. The corporation tax will increase to 25 from 1 April 2023 affecting companies with profits of 250000 and over.

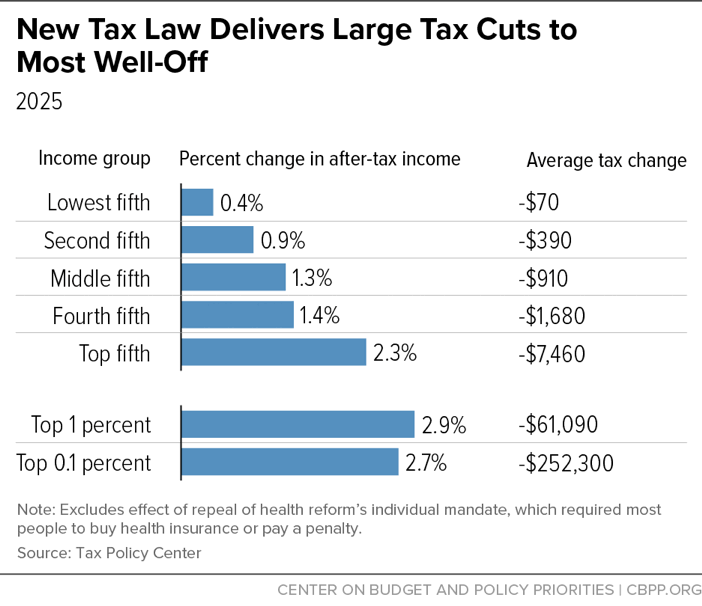

Under this the 21 corporate tax rate will increase to 28. In our new book Options for Reforming Americas Tax Code 20 we illustrate the economic distributional and revenue trade-offs of 70 tax changes including President Bidens. As a result of these taxes the top 1 would see a reduction in after-tax income of 142 taxpayers between the 95th and.

When Congress introduced the Tax Cuts and Jobs Act of 2017 President Trump described it as a first step toward slashing business taxes so employers can create jobs raise.

Should The Corporate Income Tax Rate Be Raised

Companies Adjust Strategies After Corporate Tax Cuts Accounting Today

Corporate Tax Rate Increases The Good The Bad And The Ugly

29 Crucial Pros Cons Of Taxes E C

What The Tax Cuts And Jobs Act Means For States A Guide To Impacts And Options Itep

Tax Cuts And Jobs Act Of 2017 Wikipedia

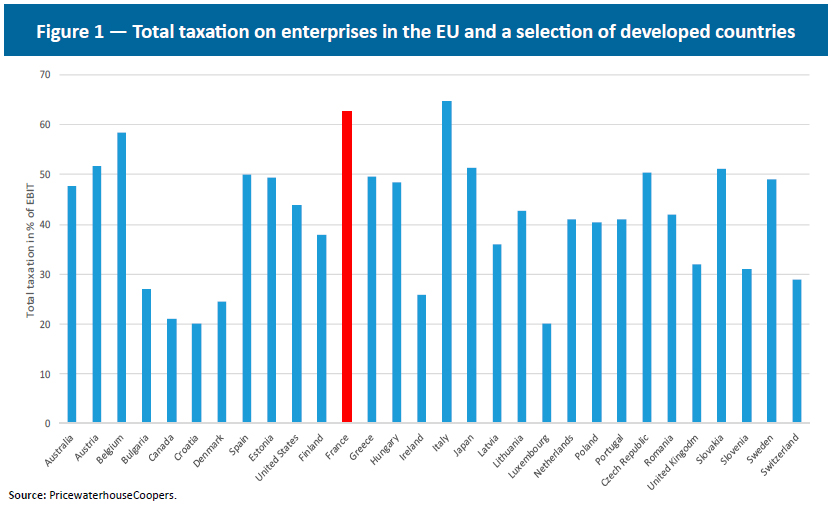

Taxation And Its Negative Impact On Business Investment Activities Institut Economique Molinari

Why Temporary Tax Cuts Won T Generate Much Growth Tax Foundation

Lower Corporate Income Tax Rate Makes U S More Competitive Abroad

Biden Corporate Tax Increase Details Analysis Tax Foundation

/dotdash-concise-history-tax-changes-Final-c1f0cf59d4944186b5104016949957ae.jpg)

A Concise History Of Changes In U S Tax Law

The Relationship Between Taxation And U S Economic Growth Equitable Growth

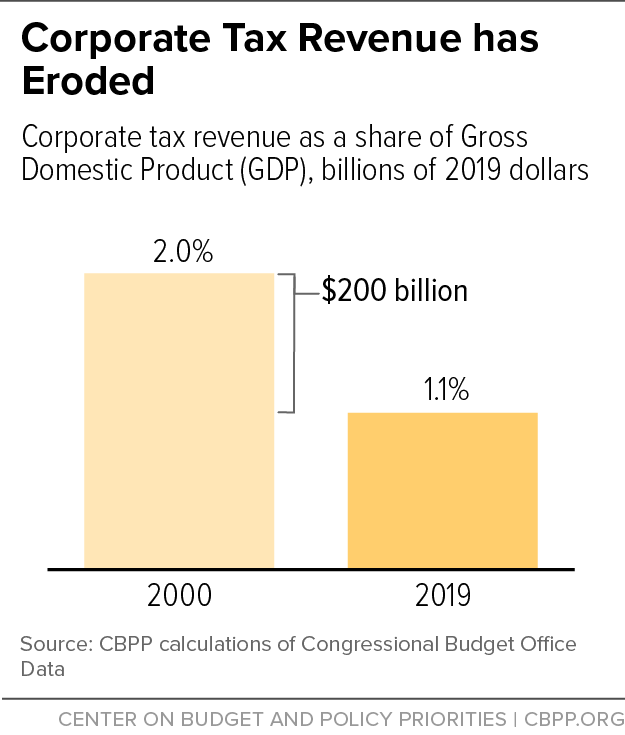

Corporate Rate Increase Would Make Taxes Fairer Help Fund Equitable Recovery Center On Budget And Policy Priorities

The Relationship Between Taxation And U S Economic Growth Equitable Growth

:max_bytes(150000):strip_icc()/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg)

Tax Cuts Definition Types Effect On Economy

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities